In recent times, the global financial landscape has been nothing short of dynamic, with markets experiencing notable shifts in volatility. In this article, we investigate the current state of volatility in key markets across the globe. In doing so, it becomes evident that volatility has made a return, shaping investment strategies and influencing decision-making processes. Discover factors driving these fluctuations and insights to navigate the financial landscape.

What is volatility?

Volatility, within the context of financial markets, refers to the degree of variation in the price of a financial instrument over time. It is a measure of the rapidity and magnitude of price changes and is often used to assess the risk associated with an investment. High market volatility suggests that the price of an asset can fluctuate dramatically in a short period, indicating higher risk, whereas low volatility indicates a more stable investment environment. Understanding market volatility is crucial for investors and financial planners alike, as it helps in making informed decisions about asset allocation, risk management, and investment strategies.

Market volatility performance

The second quarter of 2023 was filled with hope that interest rates were nearing their peak, and markets could look beyond an environment where rates continue to move upward. The third quarter of 2023 has shown inflation concerns continuing within developed markets, resulting in downward movements in both equities and bonds. We predict that rates are now close to their peak and are likely to remain at this higher level for longer than expected. This has resulted in a drop in markets.

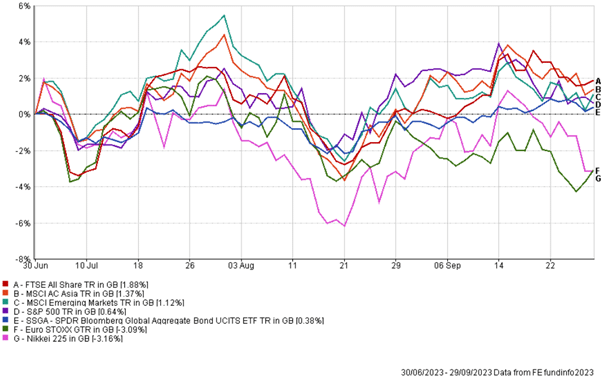

The stock volatility chart below highlights the returns of major indices over the third quarter of 2023. As we can see there was a volatile journey experienced in all areas of the global market.

A stock volatility chart outlining market performance across the third quarter of 2023.

Market volatility returns to the US

Last summer was a bit of a roller coaster for US stocks and bonds, and it left many investors scratching their heads. Despite the US Federal Reserve’s efforts to cool things down with higher interest rates, the economy continued to surprise by growing more than expected. This growth means lowered interest rates are likely to be further away than originally expected. This negative sentiment resulted in major US stock markets ending at near zero growth.

The Federal Reserve took a break from raising interest rates in September but hinted that they may revisit at some point in 2024 and keep rates high. This market volatility didn’t sit well with the global markets, especially with commodity prices on the rise, which meant that inflation was here to stay. At the same time, the Fed members are contemplating fewer rate cuts next year, causing Treasury yields to spike which also resulted in volatility to remain in global markets.

Due to ballooning US government debt, in August, Fitch, the US based credit ratings agency, downgraded the US, raising concerns about the country’s finances for the next three years. These lower ratings result in higher yields, increasing the cost of borrowing; these higher borrowing costs didn’t do any favours for the stock market and put a volatility squeeze on government budgets, leading to even bigger deficits. This created uncertainty around the globe.

During the third quarter, we saw the US Consumer Price Index (CPI) for August jump up by 3.7% compared to the previous year, largely because of soaring oil prices around the world. However, if we look at the core CPI, which excludes energy costs, it moved in the right direction; down from 4.3% in August to 4.1% in September. That’s good news for central banks that have been working hard to keep inflation under control with their aggressive rate hikes.

Positivity in the UK

On a brighter note, the UK’s FTSE All share did well, going up by 1.88% during the quarter, thanks to higher prices for oil and commodities and a weaker pound. However, economic growth in the UK remains stagnant in real terms, and continues to be at the mercy of future inflation data.

Towards the back end of 2023, inflation in the UK continued to drop after spiralling out of control following the pandemic. Many economists have predicted that inflation rates in the UK are likely to hit the Bank of England’s 2% target by the end of the second quarter of 2024. Low inflation often leads to lower interest rates, prompting investors to seek higher returns in riskier assets like stocks, potentially increasing market volatility. Stable prices resulting from low inflation can also boost confidence, which lowers market volatility. Ultimately, while low inflation can have both stabilising and destabilising effects on markets, its impact on market volatility is complex and multifaceted. Following inflation data is therefore crucial.

Light at the end of China’s tunnel

In China, property market concerns kept growing, sparking market volatility. The government took measures to combat concerns by lowering mortgage rates for first-time homebuyers and making it easier to buy homes. These actions were intended to boost the economy, which has been slow to recover after the pandemic. Despite all this, market sentiment towards Chinese and Hong Kong stocks turned negative, and both markets experienced downturns during the quarter, albeit ending in positive territory. However, we believe China continues to present attractive long term investment opportunities. Their stocks present more attractive earnings multiples than US ones, and recent market sentiment suggests that the Chinese economy may begin to speed up. It is possible the actions the Chinese government took to boost the economy, like lowering rates and subsidising childcare, haven’t had their full effect yet. Therefore, the possibility remains that we may witness more growth next quarter.

Looking ahead

In a nutshell, both the Federal Reserve and the Bank of England raised interest rates quickly, and now central rates are above 5%. The strength of developed economies has surprised everyone, but these high interest rates will continue to put pressure on the economy and cool off inflation. Interest rates will stay high until we see signs the economy and inflation are cooling down. With borrowing costs rising, businesses with strong finances will be more resilient during any economic slowdown. Our core belief of investing in high-quality companies with a track record of growing their earnings will continue. Our investment partners all continue to keep a close eye on global markets as further events unfold.

If you would like further information on market volatility in the global markets, please get in touch with our team of financial planners today. Our expert team can shed light on issues including a market volatility squeeze and have access to sock volatility charts which are incredibly important for financial investing. Trust in our unrivalled knowledge of financial markets.

Contact our financial planning team today, and see how we can help. Our team of experts can provide financial advice for both businesses and individuals, specialising in a range of matters including wealth management and retirement planning.