The first half of 2023 presented a pleasant surprise to global stock markets and the world economy. The second quarter of the year, as shown in the chart below experienced a strong rally in some parts of the market. Whilst this was clearly welcome by investors, particularly after a painful 2022, some worry that the sudden rise in some areas of the market could be overlooking some of the deeper risks which remain.

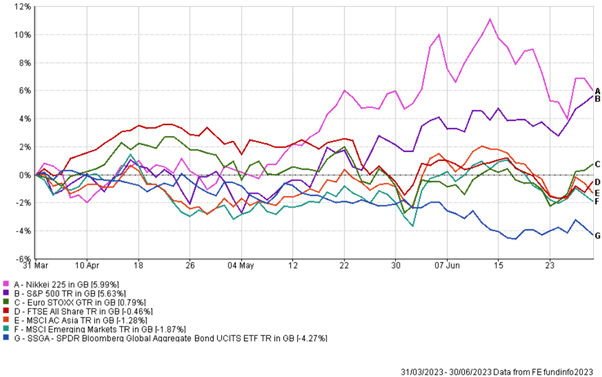

Q2 2023 Index performance

The chart above shows the performance of the world major stock market indices over the second quarter of the year. We see all indices had a similar start following on from a volatile Q1, however halfway through the year, we notice the US based S&P 500 and the Japanese Nikkei storm ahead, achieving returns of 5.63% and 5.99% respectively for the quarter. Most other indices experienced a much less volatile journey, with the Euro Stoxx just managing to retain a positive return, with the remaining indices, the UK based FTSE All share, Asia and Emerging markets all delivering negative returns for the quarter. The Global bond index achieved the lowest return in the group, in line with expectations as we witnessed central banks continue with their plan to raise interest rates to combat inflation.

Wary of risks

The sudden rise in some areas of the market shows us that markets could possibly be overlooking the risks that remain in the economy. This puts more attention on the importance of risk management and asset allocation. Asset allocation is a powerful tool for mitigating risks within investment portfolios and involves diversifying investments across different asset classes, such as equity, bonds, and alternatives to achieve an ‘all weather’ investment strategy.

Major trends

As the previous chart shows, the US stock market experienced strong returns this year, this was primarily driven by a handful of technology businesses, akin to what we witnessed in 2020. Apple, Alphabet, Microsoft, Amazon, Meta, Tesla and Nvidia all are experiencing a strong year so far. This is largely due to one common factor, exposure to AI.

Artificial intelligence, or AI has become the buzzword for 2023, regularly grabbing headlines for businesses and being one of, if not the biggest contributor to stock market gains so far for 2023. Our investments partners believe AI has the potential to revolutionise productivity and introduce efficiencies. They feel the emergence of AI represents a new structural megatrend, and like all megatrends, the impact it has on the global economy is expected to be significant. While the degree of confidence that AI will achieve strong returns is high, the risk is very high. It is important to take a sensible approach with investing in such themes, and utilising high quality investment managers to gain an appropriate level of exposure without compromising the overall level of risk taken is key to achieving strong long-term performance.

Is cash king?

2022 resulted in negative returns for most investors, whilst cash holders had opportunities not seen for over a decade with higher interest rates. Given the current market conditions, it is tempting for investors to avoid the volatility of investment markets and to hold banks deposits instead, offering rates in the region of 4.5%. However, our investment partners believe that this approach is somewhat short-sighted and should not be used as a replacement for a diversified long term investment strategy, the return on cash is expected to fall once central banks look to start lowering rates. We believe investors can continue to benefit from these higher rates through our recommended investment strategies which invest in various types of fixed income instruments within the portfolios. Our investment partners believe that equities still provide the greatest long-term return, and being invested in high quality businesses enables investors to have a more robust strategy able to manage the different stages of the economic cycle as inflation and interest rates rise and fall.

Portfolio performance

The chart above shows the performance of the three FCFP portfolios alongside the FTSE All Share as a reference point. We see that in this quarter, all three strategies provide a greater return, whilst experiencing less volatility than the UK based index, highlighting the importance of a globally diversified approach to a portfolio.

Longer term performance

To provide some context for longer term data, the chart above shows the performance of the FCFP portfolios since their inception in 2020. The portfolios now have over 3 years performance data in some of the toughest market conditions we have seen. We see the global approach in the Growth strategy continue to outperform a UK-based approach, showing the benefit of long term thinking and diversification. The Balanced and Cautious portfolio, as expected are achieving returns below that of the Growth portfolio, and continue to be in line with expectations for their given risk level.

Looking ahead

Global markets and economies have behaved kinder than originally expected, however let’s look at the economic environments we could find ourselves in over the next quarters and years.

The existing data leads our investment partners to believe the base scenario is the most likely outcome, however, as with investment markets we can never be certain of the future. The most likely outcome could well be a combination of all three. For example, a soft landing may be the outcome for global growth, central banks could retain tight policy for longer than expected to keep inflation under control due to supply chain constraints and a more resilient consumer base. Recently, we have seen inflation figures coming down in some parts of the world, however, a goal of reaching 2% inflation for this year is an unlikely outcome.

Overall, the macroeconomic environment continues to be volatile, and the investment markets are far from predictable. Our investment management committee continue to work closely with our investment partners to ensure our recommended investment strategies are positioned to tackle all stages of the economic cycle.

If you would like further information on how our investment strategies are positioned, please get in touch with your financial planner.

The value of your investment can fall as well as rise and is not guaranteed. Past performance is not an indication of future returns.