The debate of active vs passive investing has been a hot topic within the world of investment management for many years now. This has become increasingly popular given the unique market characteristics we have seen over the past 10 years.

This blog post will shed some light on the debate and provide an insight into the approach we adopt here at Francis Clark Financial Planning for our clients.

What is active investing?

Active investing is where the investment managers of the chosen funds buy and sell investments based on their own opinion of the value of the underlying securities, primarily based on their own independent research. The manager can also implement their own views into the strategy, such as being able to focus on newer, smaller companies, or targeting companies who have experienced a recent bout of poor performance. In short, an active investment manager’s main goal is to ‘beat the market’ – or to outperform their benchmark. Many do this by buying and selling under and overvalued assets respectively. An example being an active UK Equity manager aiming to provide a greater return than the FTSE All Share, whilst taking less risk.

What is passive investing?

If active investing is ‘beating the market’, passive investing is ‘being the market’. A passive investor is simply trying to match the performance of specific market indices, not outperform them. The general theory passive investment managers believe is the additional cost of employing active management (i.e. research analysts, portfolio managers etc) is not worth adopting as most active managers fail to consistently beat the respective index after fees. Passive managers feel it is more efficient to replicate the index than incur the additional cost of an active manager to attempt to beat the index. This approach has paid off recently, as passive strategies tend to perform better, after fees, in rising markets where volatility is lower than their actively managed counterparts.

Active vs passive

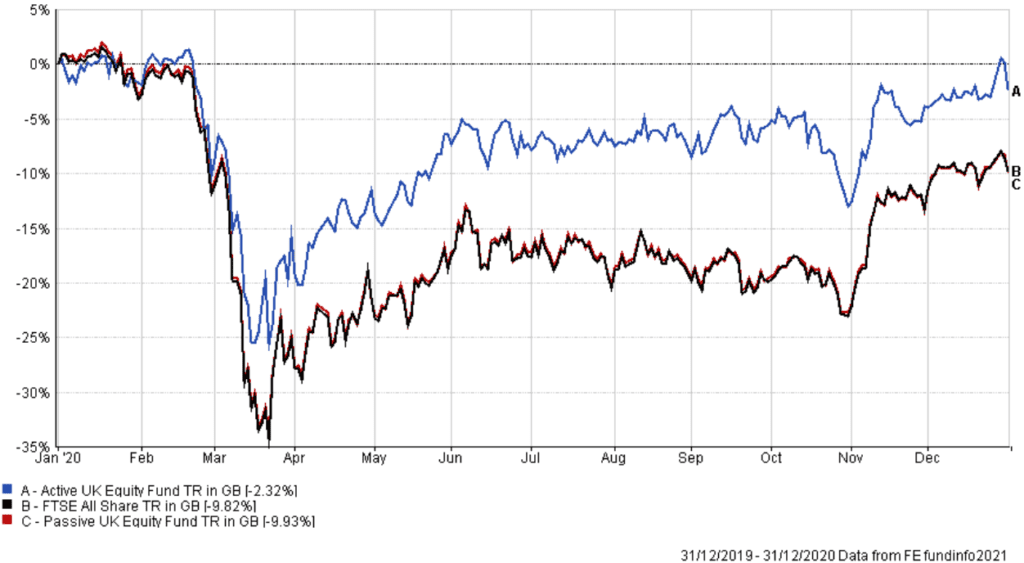

Figure 1

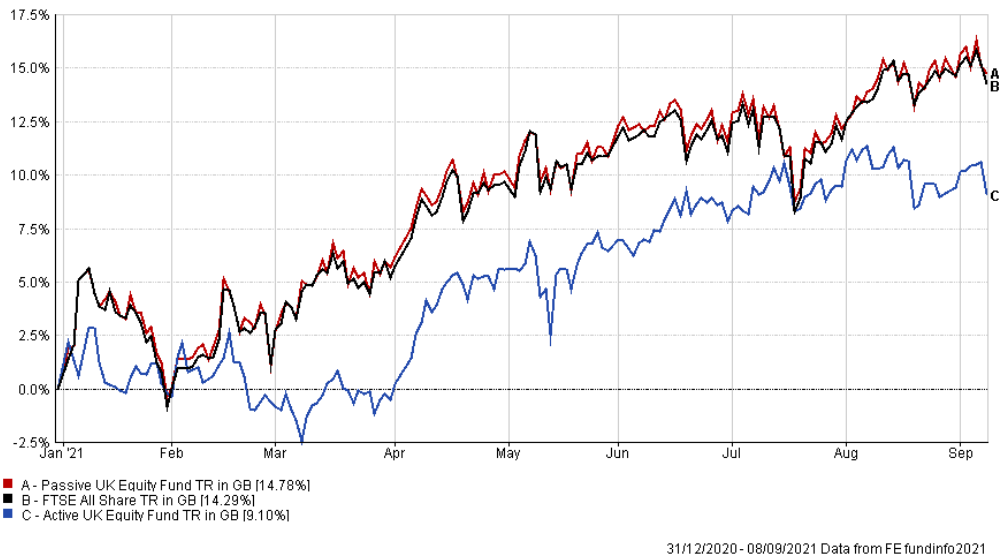

Figure 2

The charts above show the following:

- Figure 1 – 2020 Performance (bear market)

- Figure 2 – 2021 Performance year to date (bull market)

- Blue line – Active UK Equity Fund

- Red line – Passive UK Equity Fund

- Black line – FTSE All Share Index

The FCFP approach

At Francis Clark Financial Planning, we are conscious there is more to the debate than simply investing actively or passively. Markets are constantly moving, and both styles of investing have been favourable in different market conditions as shown in the charts above. For example, when volatility is low and in a general upward trend, also referred to as a bull market it is the passive strategies which often triumph (as shown in figure 2) where the passive fund, closely tracking the index, shows a higher return relative to the active option. In volatile, uncertain times, where markets generally trend downwards, referred to as a bear market, the active managers, who have the additional insight and more proactive approach towards the strategy tend to experience a better journey (as shown in figure 1) and the active fund will show a greater return compared to the index and passive funds.

With this in mind, we adopt a combination of active and passive investment strategies. Depending on the opportunities present in different market sectors, investors could get the best result from adopting both strategies within their portfolios to allow a ‘best of both worlds’ approach.

When using both styles of investing within a portfolio, something to bear in mind is that in the past, consistently ‘beating the market’ through active management has proven to be very difficult over a longer period of time, particularly in a developed market such as US equities. It makes sense to allocate active managers towards areas of the market where active management has had a higher success rate, typically in the areas with less readily available information i.e. emerging markets.

Adopting this hybrid approach should result in a more cost-efficient solution whilst still benefitting from the added involvement of active management.

Not everyone will have the same view with regards to the adoption of active or passive strategies. At Francis Clark Financial Planning we can offer our clients a range of investment solutions including a fully passive, cost conscious strategy through to actively managed portfolios. If you would like any further information on how Francis Clark Financial Planning adopt passive and active investment strategies for our clients, please get in touch with your local financial planner.