Team update: Please share your feedback in our annual client survey

November 2025

Welcome to your first Francis Clark Financial Planning team update.

Our annual client survey should have landed in your inbox by now, so we’re checking in with a friendly reminder to share your feedback.

Understanding what works for you and what you’d like to see change helps us continually improve so that we can deliver the highest standards of advice and support.

It seems we’re doing a good job so far! In last year’s survey, you told us:

- You trust our team to have your best interests at heart and deliver the advice you need

- Our financial planners are friendly, professional, and make you feel valued

- We act on your feedback, which makes you feel heard and appreciated

- We take the time to listen and understand your needs.

Here’s a brief overview of how we’ve put your previous comments into practice.

Your feedback is helping us shape and grow the business in line with your needs

We’re a business that listens and acts on what you tell us.

Here’s an overview of the themes from our 2024 survey and the improvements we made in response to your feedback.

Timescales

You told us:

Sometimes you’re not sure what to expect after a meeting with your financial planner, in terms of your actions and theirs. You also pointed out that occasionally you’ve had to wait longer than you’d like for a response to a query.

Actions we’ve taken:

We’re in the process of redesigning our support teams so that you have access to a broader base of contact. This will improve response times and ensure that you receive the guidance you need when you need it. We’re busy fine-tuning this new way of working, and you’ll see the benefits in the new year.

Preparation and accuracy

You told us:

The flow of information between financial planning and other departments within Francis Clark hasn’t been as smooth as you’d expect. Also, you want key documents to be more accurate, clear and accessible.

Actions we’ve taken:

We’re exploring a new tech solution to improve how the two sides of our business share data and talk to one another. This will make us more efficient and reduce the risk of human error.

Additionally, our communications committee has conducted a comprehensive review of the reports and letters we frequently use. They’ve given us helpful recommendations to make our communications clearer – changes we’ve already started to implement and will roll out gradually.

Communication

You told us:

That you’d like more frequent and proactive updates, such as when we make changes to the business or following annual reviews. You also said that it would be useful to have a clearer explanation of the next steps after meetings with your financial planner.

Actions we’ve taken:

Our top priority is to deliver an exceptional customer experience, and effective communication is at the heart of that. So, following the last survey, the whole team took part in training to identify new ways of working that will enhance our interactions with you and allow us to share feedback more efficiently.

We’ve embraced AI to help us provide you with clear follow-up actions promptly after meetings, and you’ll see this in action soon. What’s more, there are exciting changes happening behind the scenes to improve the client portal so that you can communicate seamlessly with us.

Service

You told us:

You want more ways of getting in touch with your adviser, and you’d appreciate more proactive advice.

Actions we’ve taken:

As part of a business-wide review of the technology we use, we’ve identified new systems that will help us keep you in the loop more effectively between meetings. These changes will also ensure that the communications we send are relevant to your needs and interests.

Our team is working hard to integrate this new technology, which we expect to be up and running within 12 months. You’ll then have access to a shiny new client portal that will make all our lives easier!

We’ll also continue to use our successful Ask, Collaborate, Transform (ACT) programme to gather feedback via surveys, interviews and forums so that we can shape service delivery in line with your needs.

Have your say – check your inbox for our 2025 client survey!

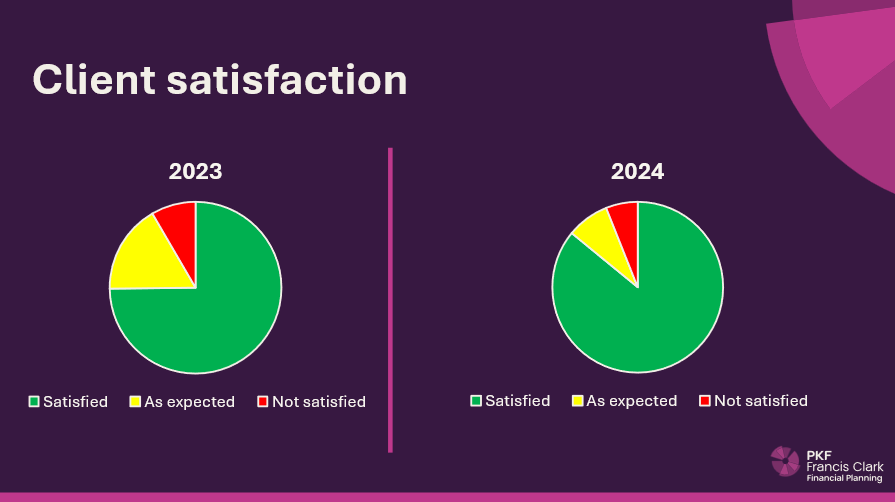

As you can see, we’ve learned a lot from previous surveys, and the changes we’ve made in response to your feedback have directly improved client satisfaction.

What’s more, 86% of you are satisfied that we understand your needs – up from 81% in 2023. We want to see that figure climb even higher in 2025.

This is your chance to have your say.

By completing the survey, you can help us develop and improve the service we offer. The only way we can make the changes you want to see is if you share your thoughts with us.

If you haven’t received your 2025 client survey, please drop us a line and we’ll gladly email another one to you. For those of you who’ve been quick off the mark and already submitted your responses – a big thank you from the whole team.

We can’t wait to read your ideas and suggestions.

Before you go, we have some exciting news to share

As we ask you to help us grow and improve the business, we have received some timely and very welcome news.

Francis Clark Financial Planning has been shortlisted for the Professional Adviser Best Client Engagement award in 2026! These prestigious industry awards recognise the most outstanding advice firms in the UK.

We’re especially proud to be shortlisted for the Client Engagement award, as this reflects our commitment to providing exceptional service. Listening to you and acting on your feedback is at the heart of this, so please do share your thoughts in our client survey.

Watch this space for more news on our Professional Adviser award journey.

Contact us

Do you have some feedback you’d like to share? Complete our form with your comments and let us know how we can help you.