Investment Update: Market commentary Q4 2024/5

Inflation and interest rates continue to impress

Overall, markets are seeing inflation come down slowly. In the UK we had a pleasant surprise of 2.5% inflation at the latest update and in the US 2.9% is still in line with market expectations.

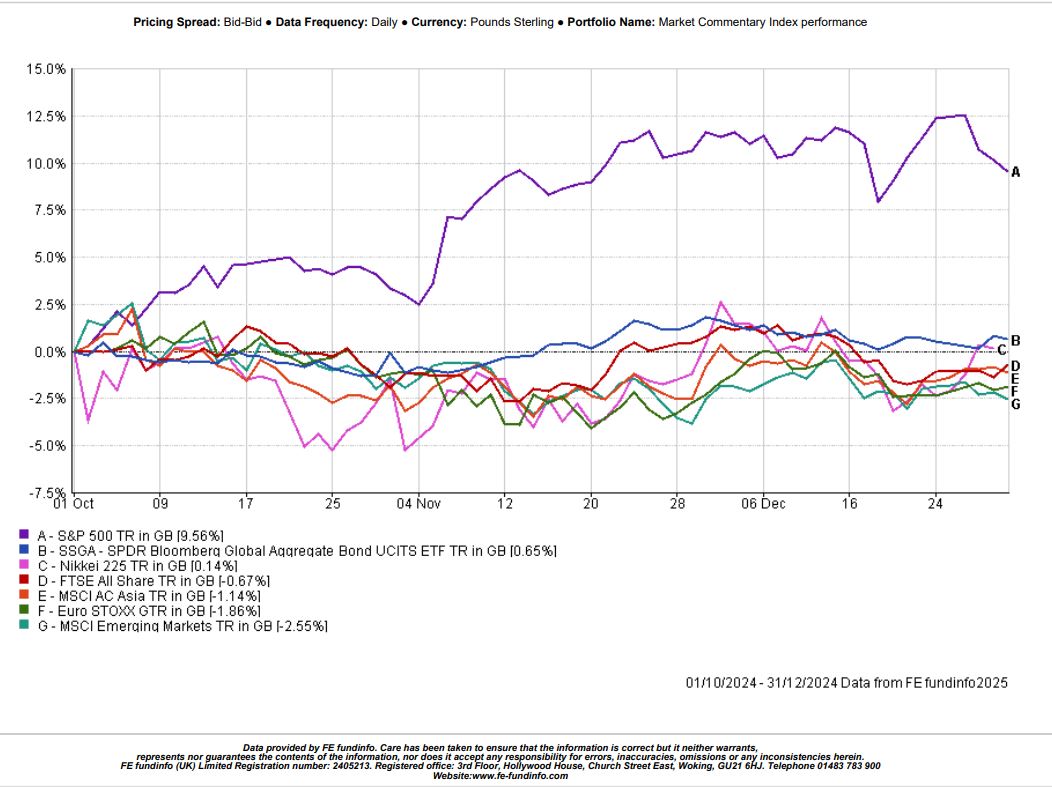

Index performance

Through the final quarter of the year, most global markets were flat. Asia, Emerging markets and Europe finished the quarter slightly negative, whereas Japan, the UK and bonds markets pretty much remained flat. The exception in global markets was the US – like the rest of the world it started the quarter off calm, markets jumped following Donald Trump’s victory in the US elections and remained at higher levels, finishing the quarter up 9.56%.

The risk of AI

There is a lot of noise around the risk around artificial intelligence in 2025, and while the risk is certainly present, there is no need for panic. Throughout 2024, AI stocks were the most popular amongst equities, a lot of which was built up around the expectation of future returns. With this style of investing, individuals bear the risk that if the companies fail to deliver on those high expectations, the underlying share price, can result in significant volatility and potentially negative returns.

We witnessed an example of this risk of AI this week, shares in chip maker Nvidia dropped by 17% on Monday in response to a new entrant into the market from China. We continue to keep an eye on markets while they continue to assess the impact of a new, competitively priced entrant.

However, the example above shows us that a well-diversified portfolio, with a global mandate and a mix of investment styles, such as value, quality, growth and momentum is much more likely to be well protected in the event of a downturn in this area, compared to a portfolio built using solely AI focused stocks.

Looking ahead

One challenge investors potentially face in 2025 is the inflationary pressure of a Trump presidency. Whilst Trump’s victory has clearly proved to be good for markets, it is expected that it brings with it further inflationary pressure which, if not contained, could result in inflation figures taking much longer to come down to target levels – or even creeping back up.

We continue to keep a close eye on global markets and maintain a well-diversified approach across our portfolios to ensure the greatest chance of achieving strong risk-adjusted returns over the long term.