Ask. Collaborate. Transform

Our client listening and feedback programme

Your feedback helps shape a better client experience

We believe in the power of listening to our clients. By understanding what they value and where we can improve, we continuously refine our service to meet their needs. Every piece of feedback is viewed as an opportunity to enhance the client experience we provide.

How does our client feedback work?

We run a continual client listening programme, A.C.T. (Ask, Collaborate, Transform) and we have partnered with Insight6, an independent client experience consultant, to enhance our programme with unbiased surveys and interviews. This collaboration ensures we gather authentic insights to drive our service improvements.

What’s included in our A.C.T programme

What our clients say

86% of clients are satisfied with our service

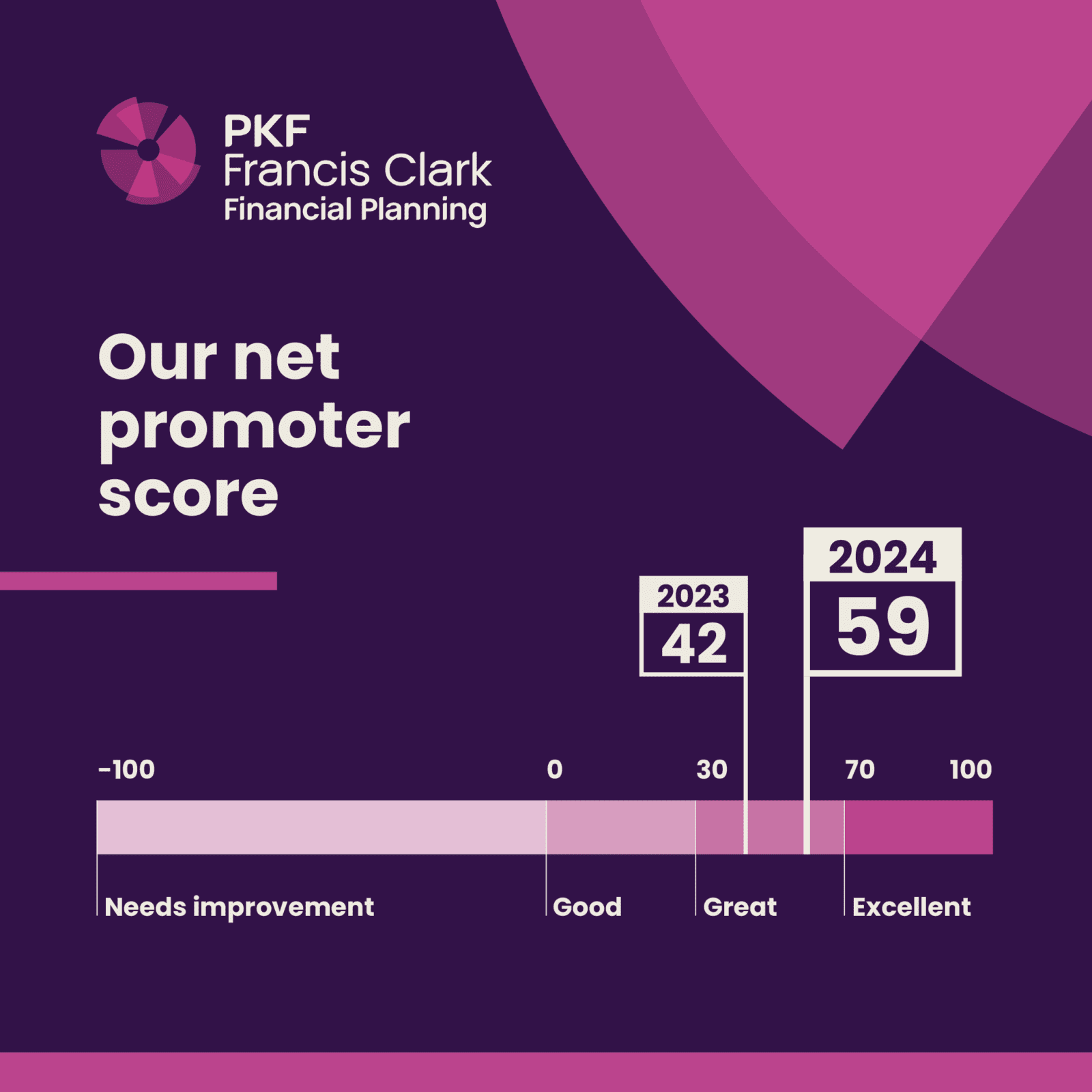

The Net Promoter Score (NPS) is a key metric used to measure customer satisfaction and loyalty. Clients rate how likely they are to recommend a company on a scale from 0 to 10. Those who give a 9 or 10 are considered Promoters (satisfied and enthusiastic), while those who score 0 to 6 are considered Detractors (dissatisfied). The NPS is difference between the percentage of Promoters and Detractors. The NPS score is the difference between the percentage of Promoters and Detractors.

Our current NPS is 59, which is 25% higher than the industry average for finance.

Get in touch

Your feedback is invaluable in helping us achieve this goal. For more information and enquiries about our client feedback, please contact Charlotte Taylor-St Ruth, our head of client experience.