Markets breathe a sigh of relief: Market commentary Q1 2023

Keeping on trend with 2022, this year did not start without volatility. After witnessing data suggesting a softening of prices, markets experienced rises in equities and bonds during the early months of the year. However, this was short lived as February saw the possibility of continued inflation through strong growth figures and labour market data, alongside falling natural gas prices and the re-opening of the Chinese economy post-COVID. This all pointed towards the likelihood that the tightening cycle was far from ending. The remainder of Q1 therefore saw heightened volatility, though all markets finished the quarter in positive territory, albeit with plenty of uncertainty.

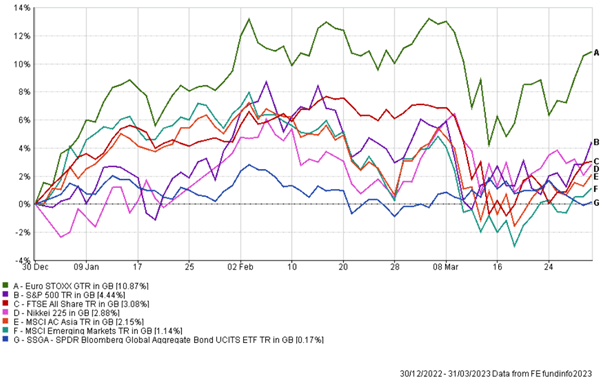

Index performance

The chart above shows the global performance of the world’s major financial indices over the past quarter. We see the evidence of another volatile quarter, much like the end of last year, and in the same way we also see European markets leading the pack on returns again, largely due to strong economic data and positive sentiment around geopolitics and natural gas levels. We also see the US and the UK going through very similar journeys, with the US outperforming slightly with a return of 4.44% compared to the UK’s 3.08%. Japan and Asia Pacific also experienced similar positive journeys to one another for the quarter, Japan achieving a return of 2.88%, followed by China with its recent reopening of the economy leading to a stock market return of 2.15%. Emerging Markets achieved the lowest return out of the equity indices, with a return of 1.14%. The Global Bond index fared worst of all however, just remaining in positive territory with a total return of 0.17% for the quarter. Whilst the range of returns varies amongst the different regions, we feel reassured to see positive returns across all sectors for the second consecutive quarter.

Strong economic data

Q1 saw a strong start for global markets, primarily due to the economic data released in January. Strong labour market data suggested unemployment rates moving below their pre-pandemic levels for most of the world’s major economies. Europe also experienced positive data due to the milder winter than forecast, which helped avoid a climate crisis in the region. Whilst seemingly positive, this suggests that the pressure on pricing and therefore inflation remains a concern. This would indicate to markets that initial assessments on peak interest rates may need to be reassessed to keep up with ongoing pricing pressures. This would push back on any hopes that rates may be cut on the back of a recession.

It was not only the western economies experiencing strong economic data. As mentioned in the previous update, China rowing back on their zero-COVID policy and reopening their economy resulted in a significant rise in economic activity, with the benefits not only enjoyed in the domestic economy, but also contributing towards additional growth in Europe and other parts of Asia. However, the geopolitical tensions between China and the West continued to add negative sentiment toward the regions.

Central banks continue to manage inflation

With January data looking increasingly positive, it appeared that global economies would be able to continue enduring growth without experiencing any form of recession. However, this also highlighted that whilst pricing pressures remained clearly present in all areas of the economy, rate hiking could need a longer run and a subsequent rate cut could be some time away. Central banks continue to monitor macroeconomic data to understand the level interest rates must reach before being confident inflation can be contained.

Headline-making events

Some form of ‘casualty’ within the various global economies was inevitable. We are in the midst of one of the fastest and most aggressive rate-hiking cycles in history and therefore have to expect negative impact on some businesses. March saw a drop in the cryptocurrency markets following the announcement of the collapse of Silicon Valley Bank (SVB). The collapse of the bank highlighted the dangers of aggressive rate hikes and the impact it can have on business.

Whilst certainly representing a banking crisis, the collapse of SVB is unlike those we previously witnessed in the global financial crisis of 2007/08 – however we did see an emergence of concerns around contagion. Fortunately, swift action from central banks across developed markets ensured the problem was contained, with the news that all deposit holders were guaranteed access to their money being received well.

The collapse of SVB was not the only high-profile banking failure the markets witnessed in March. The Swiss banking giant Credit Suisse also collapsed after being in operation for 167 years. The problems within the bank had been present and noticed within markets for a few years, and the issues within the business are more likely due to misconduct and gross mismanagement, rather than a repeat of the banking crises we saw in 2008. The Swiss national bank was once again swift to take action to calm markets by ‘orchestrating’ a takeover of Credit Suisse by UBS. This, however, was not without pain, with subordinate bondholders being wiped out in the process.

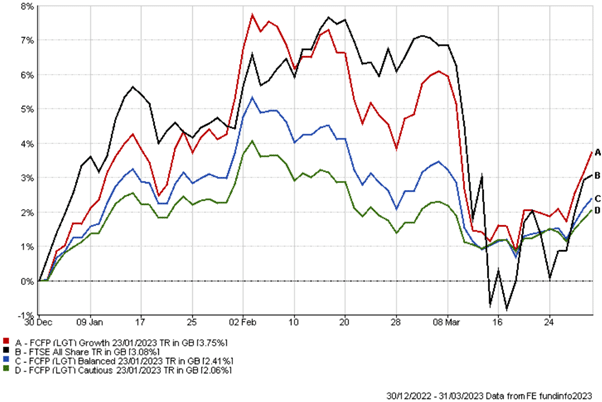

Portfolio performance

The chart above illustrates the performance of the three FCFP portfolios alongside the FTSE All Share as a reference point. Recent quarters saw the UK-based FTSE outperform, with greater volatility in all three portfolios. However, this quarter we see the more global approach adopted within the FCFP Growth portfolio achieving a slightly greater return for the quarter. The two lower risk, more diversified portfolios have shown a slightly lower return, but with significantly lower volatility, within expectations.

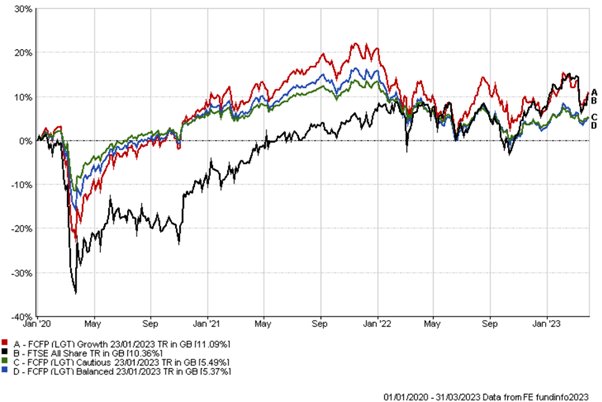

Longer term performance

To provide some context for longer term data, the chart above shows the performance of the FCFP portfolios since their inception in 2020. The portfolios now have over 3 years performance data in some of the toughest market conditions we have seen. We see the global approach continue to outperform a UK-based approach, showing the benefit of long term thinking and diversification.

Looking ahead

The recent banking crises has left central bankers with tough decisions to make regarding the pace of the remaining rate rising cycle. It is expected that banks are more likely to impose tighter capital conditions, which could result in further rate hikes as lending standards are increased. We could however see an end coming to this tightening cycle, with perhaps just one more rate rise in May before a much-awaited pause by central banks.

Every cycle is, of course, different however this one more so due to the pandemic. It is expected that we will see the impact of these higher rates continuing to appear within different parts of the market albeit at a different pace. The ‘lag’ to react to interest rate changes can sometimes be long and now we have reached 14 months since the first rate rise, it is expected that economic activity and pricing pressures should begin to come down slightly which, we hope, will finally bring greater control over problematic inflation. Our investment management partners continue to regularly monitor the economic climate and manage our investment propositions to ensure all strategies remain closely invested to the original mandates. Whilst market volatility remains present, we continue to remind clients of their original long term objectives, emphasising that trying to ‘time the market’ is almost always a worse tactic than relying on time in the market.