Uncertainty in the stock markets: The importance of diversification

Last week we spoke about the uncertainty within markets, and how this was expected since Donald Trump took over presidency in the States. Since then, uncertainty has spread further and pushed US stock markets into a downfall.

Stocks falling is never nice, but we often forget that stock market corrections are actually quite frequent. That is why it remains our view that diversification is the greatest tool to tackle uncertainty.

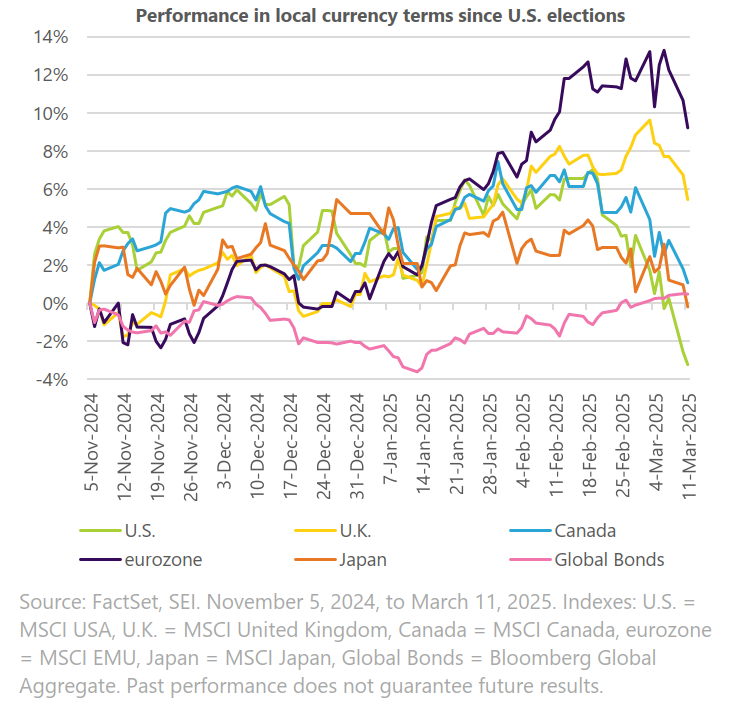

The chart below shows how frequent stock market corrections are each year.

Market drops of 5 – 10% occur, on average, more than three times a year. Even market drops of 10%, on average, occur once a year. Thankfully, more significant downturns happen less frequently. Remember when we look at longer term market returns, these figures assume that investors stay invested through all types of market environment. When investors try to buy low and sell high, this perceived timing of the market usually results in a worse outcome.

What are we watching?

Tariffs

The uncertainty around tariffs is having the greatest impact on global markets.

Inflation

Particularly in the US, inflation is proving to be more stubborn than expected, currently sat round 3%, well above the Fed’s 2% target. Many companies are still facing supply chain issues and the impact of tariffs is yet to be felt in some areas which is likely to result in further price increases.

Economic growth

We have seen many central banks, such as the UK and Europe, revise growth rates to highlight slower economic growth over the next few years. The US economy has performed well, however recent data is implying slower growth rates lie ahead.

Valuations

The magnificent 7 stocks (Alphabet, Apple, Amazon, Meta, Microsoft, NVIDIA and Tesla) and a lot of US equities have been at historically high valuations, priced for a perfect economy going forward. If economies experience negative change, this could have significant impact on growth focused stocks.

Geopolitics

Russia/Ukraine, Israel/Palestine, Iran and possible concerns over fractures in NATO have added further uncertainty to markets.

Diversification is key

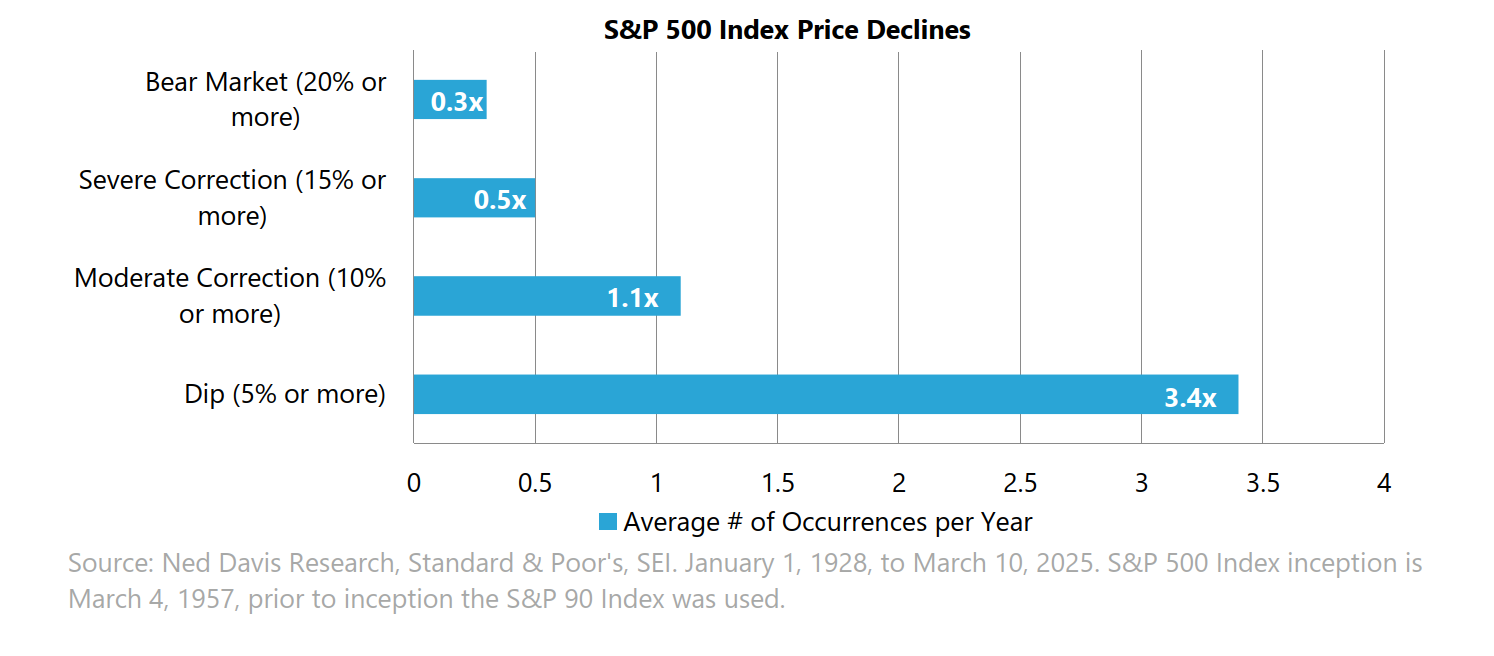

While diversification doesn’t protect against all losses, it can provide a smoother journey through volatile market conditions. Shortly after the US elections in November last year, the US S&P 500 hit all time highs as investors deemed a Trump presidency to be good for markets. However, the tariffs he has since put in place have sparked uncertainty within markets and we have seen the US in particular experience a sharp drop.

The chart above shows the performance of the US stock market, measured by the S&P 500 index alongside other indices. What we see is that whilst the US has experienced a sharp drop, other regions have had a different journey. The chart highlights to us the importance of retaining a global view in portfolios to provide a layer of protection against such risks.

Our view

Due to the change in the global economic landscape, we have felt the best way to tackle markets is through active management. By using high quality managers, who are specialists in their field, we believe this better positions our portfolios against the uncertain times ahead.

Our FCFP portfolios have a current theme within them to tackle ‘sticky’ inflation, investing in areas which are positioned for inflation to continue above the 2% target, as well as a slight bias towards value stocks which historically have performed well during times of market uncertainty. Doing so has resulted in an underweight position in the technology focused ‘magnificent 7’ stocks which, while still playing a part in the portfolio, present a greater level of risk during uncertain times.