Timing the market’ Vs ‘Time in the market

We are often asked ‘what we are doing about it’ when there is a dip in the market. The past few years have seen increased volatility and our advice, if you don’t need access to the money, is to hold your nerve, stay the course and wait for markets to recover. Selling when markets are down and not returning to the market before they bounce back can have a huge negative impact on investment returns.

Generally when we are asked this question, the markets have already had a downturn. History has shown that investors who panic sell in these situations rarely time returning to the market well, if they return at all, therefore making that loss permanent.

It is easy to think that the best way to extract returns is to ‘time the market’, that is to buy an investment when it is priced low, and to sell it as it gets high. If perfectly executed, this strategy would yield phenomenal return on investment by removing any downward movement in the price. However, if wrongly timed by even a day or two, it can potentially lead to a worse result than not having interfered in the first place. Market movements are difficult to predict, even for seasoned investment professionals and requires a significant amount of luck. Whilst episodes of volatility in rising or falling markets are completely within the norm, trying to time the ‘perfect’ entry and exit point is extremely difficult and can result in a negative outcome relative to taking a more patient approach as shown in the chart below.

The chart above shows the annualised returns of the global equity strategy from 2000 – 2024. We see that by missing the 10 best days would result in a £21,506 of missed growth relative to staying invested and missing the 40 best days would not only lose out on any growth it would deliver a loss of original investment.

Instead of trying to predict when to buy or sell, simply staying invested in the market over the long term, ignoring the short term ‘noise’ of market volatility is the best course of action.

Resisting the urge to try and time the market

We understand that in times of uncertainty, it can be hard to remain calm if you see a decrease in the value of your investment. Your financial planner is here for you during these times, to listen to your concerns and help to overcome your worries.

The chart below shows the journey of three identical £10,000 investments, with a medium risk approach during the global financial crisis of 2007 through to 2010– we have charted three different actions and the effect this had on the end value.

The first approach shows the effect of simply leaving the money invested and doing nothing else. The second highlights the impact of selling after the market sell off and then re-investing after one year. The final strategy shows the result of selling after the sell off and then leaving the capital in cash.

Evidently, the first strategy has resulted in the greatest value by some way and is the only approach that has shown a return above the initial investment. This illustrates that despite what can sometimes appear to be a ‘scary’ sell off, it is important for investors to retain a long-term view and stick to their original objectives, unless there has been any fundamental change in their own circumstances. It is advisable to speak to your financial planner if you’re thinking of selling because of market volatility.

Markets generally trend upwards over the long term

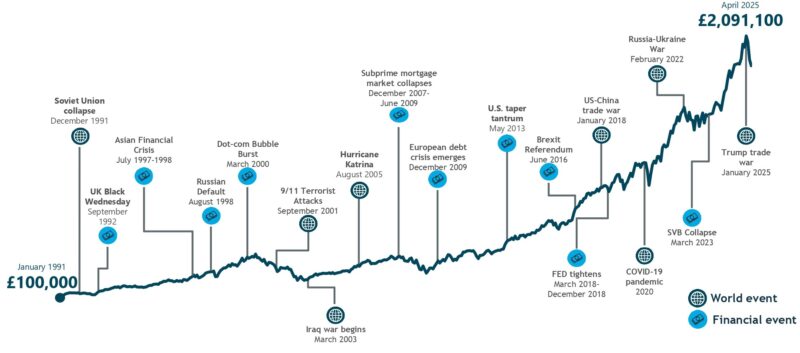

The chart below shows us the journey of £100,000 invested in January 1991 through to April of 2025. During this time, the world has experienced many challenges and as we can see below, the stock market endured several periods of heightened volatility and sharp selloffs. However, despite this, over the long term we can see a significantly higher value in 2025 compared to 1991, showing the benefits of compounding and simply spending more time in the market resulting in a greater return over time.

What next?

The current market environment and the challenges investors face are very complex; however, we believe the solution is generally simple. The best results have historically come to those who remained calm in times of market distress and stay true to their original objectives, taking a long-term view.

At Francis Clark Financial Planning, we continue to believe that high quality investments into a mix of asset classes in a geographically diverse strategy remains the best route for the majority of investors.

We understand that the current environment is full of challenges, we are in a market riddled with geopolitical uncertainty, as well as a tougher macroeconomic environment than we have been used to. Our message to clients remains the same, keep calm in challenging times, focus on the long term view and have faith in a well-managed global portfolios ability to manage challenging markets over the long term.