The importance of cost when looking at portfolio management

Generally, when it comes to cost people don’t like to spend more than they need to and the same principle should apply to an investment portfolio. Investors aim to maximise returns as much as possible within their risk profile and all at a cost that represents good value.

At Francis Clark Financial Planning, we don’t have the ability to control the behaviour of financial markets, nor predict exactly how global markets will behave. We strongly believe reducing costs where appropriate within an investment portfolio is one of the most effective ways of maximising returns. Of the many variables that affect investment returns, cost is the only one that is known in advance and that can therefore be controlled by investors. The amount an investment manager charges reduces the gross return for an investor. In simple terms, if an investment manager has achieved a 4% return in a year, but charges a 2% annual management fee, the investor will achieve a 2% return. If your goal is to maintain pace with inflation and you have known costs of 2% then the gross return required to meet your goal is inflation +2%. By reducing this target to inflation +1%, and reducing cost by 1%, it is easier to achieve the same goal.

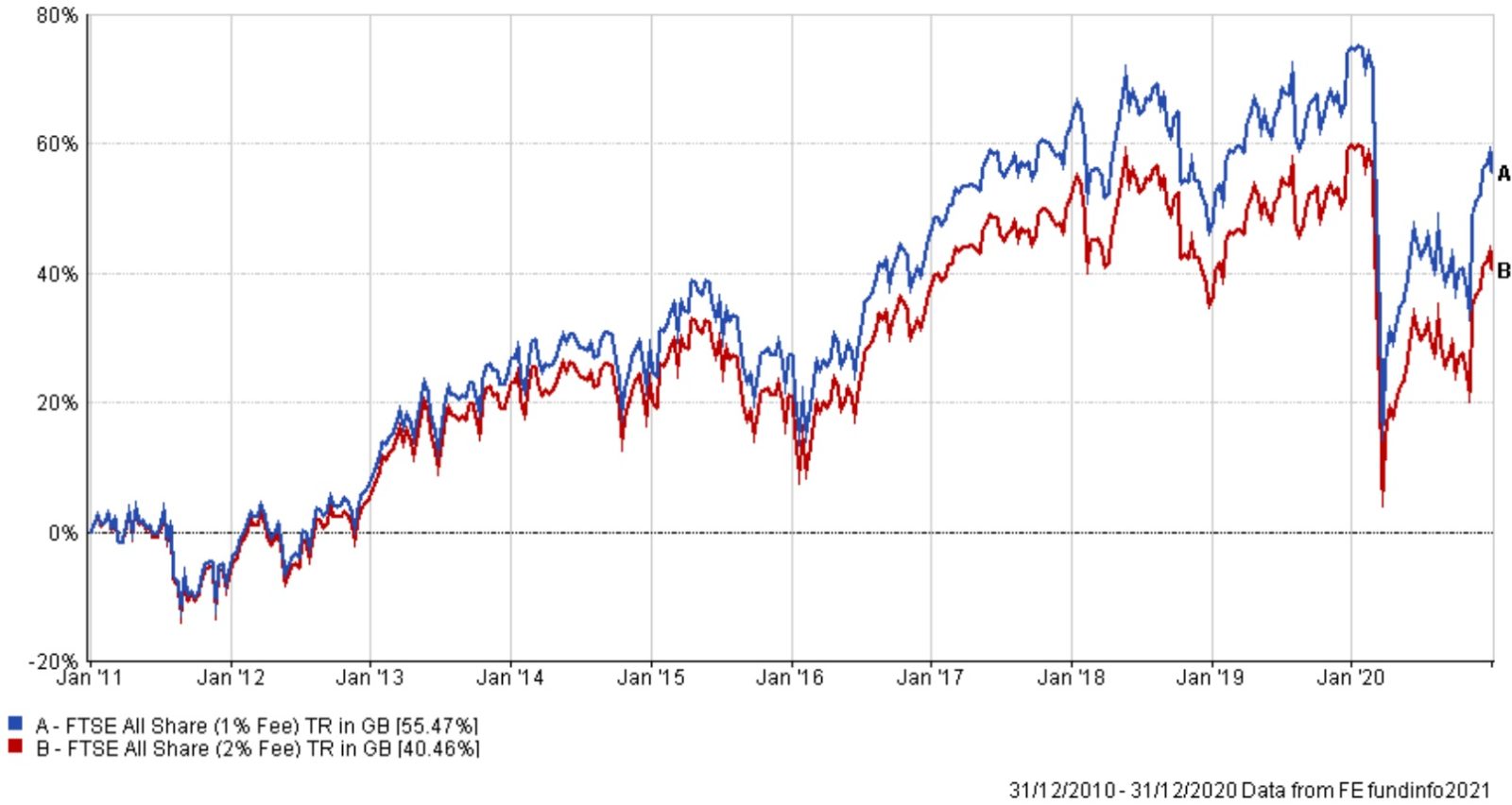

The chart below illustrates the effect additional fees can have on the net returns of an investment.

The chart uses two identical investment strategies with 100% allocation into the FTSE All Share. Portfolio A comes with a management fee of 1% and Portfolio B has a management fee of 2%, a cost difference of 1%.

A 1% difference may not seem like much, however the effect over time can mean a sizable difference in long term returns for investors. Portfolio A, with a 1% management fee, achieved a total return of 55.47%. Portfolio B achieved a return of 40.46% over the same period; a difference of 15.01% for the same investment strategy.

Changes in regulation mean there is now more scrutiny on costs and charges than we have ever seen before. MiFID II regulation requires more detailed information to be provided about the fees a client pays on their investment portfolios. This new set of regulations is good news for investors, giving them a clearer understanding of the fees they pay. It is reassuring for financial planners too, as it provides us with greater clarity on the real impact a recommended strategy will have.

Costs are certainly important but cheap doesn’t necessarily mean better; value for money should be the focus. Selecting the right investment strategy is the most important factor when it comes to meeting a client’s objectives. Sometimes it pays to incur higher costs when the net returns are greater or more appropriate.

Our investment management committee takes great care to carry out in-depth analysis when selecting investment partners to manage our clients’ portfolios as part of our investment planning services. We only partner with trusted companies with strong track records in investment management whilst keeping costs competitive. Our goal is to access high-quality managers seeking to achieve above-market returns where they see opportunity, whilst being conscious of costs. We aim to provide high quality, actively managed proposition for our clients, reducing costs where possible, without sacrificing quality or potential growth.

written by