Market optimism on the rise

The final quarter of 2023 provided investors with a much-needed rally across markets, resulting in a sharp increase in market optimism. Equity and bond markets both ended the year in a much better position than in the past two quarters. Investors were expecting to see continued drops in Q4, so the rally provided a nice boost to investor sentiment and market optimism.

The rallies were primarily due to the recent inflation data installing confidence in markets. This indicated that interest rates had reached their peak and investors can finally start preparing for much awaited rate cuts. Ultimately, when market optimism increases, investors have more confidence in their investments and are less sceptical about investments potentially failing. Market optimism can often result in more risk tasking when it comes to investing.

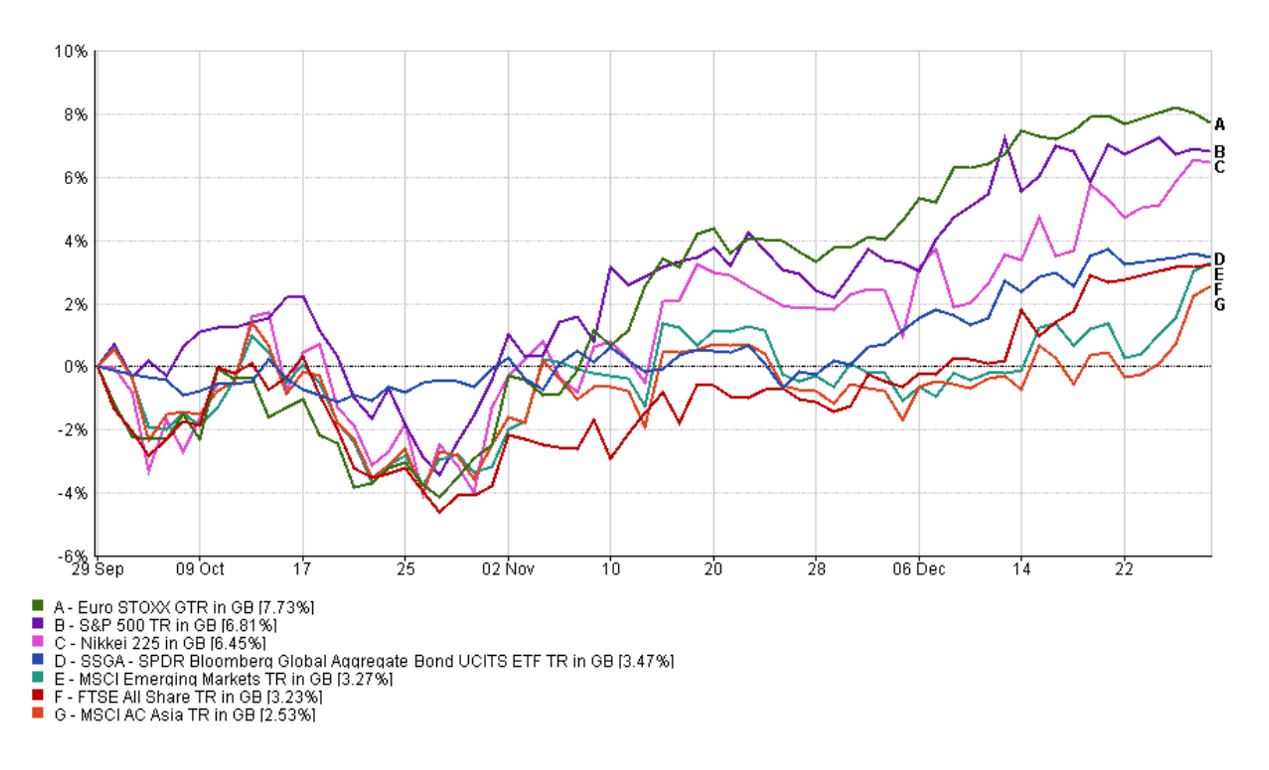

The chart shows the returns of major indices over the final quarter of 2023. Generally, the graph highlights an upward trend in market optimism over the final quarter across global markets.

Positive outlook from federal reserve

Towards the end of the year, we saw the chair of the Federal Reserve, Jay Powell present markets with some positive sentiment around the outlook for interest rates; implying that we were not only at the end of the hiking cycle, but markets could even look forward to rate cuts in 2024. Following on from this, the UK and US both produced inflation data that was lower than expected, fuelling market optimism. This was hugely positive news for the investment outlook.

Markets enjoyed growth from this renewed confidence in central banks’ ability to control inflation, resulting in a drop in bond yields, providing uplift to both fixed income investments as well as equity markets. Recent inflation data has been falling faster than central bank’s expectations, which provides an opportunity for policy makers to reduce interest rates throughout 2024.

The Federal reserve’s pacifying stance in the December meeting caused a rally across equity and bond markets, improving market optimism for investors and consumers. This stance is potentially setting pace to stimulate economic growth before the interest rates are cut.

Investors will keep a close eye on the correlation between equity and bond markets, waiting to see a return to negative correlation between the two asset classes. This would enable investors and portfolio managers alike to return to using fixed income as a natural hedge to equity markets, providing protection in times of equity volatility and ultimately renewed market optimism.

Looking beyond AI

A popular narrative for 2023, one that increased market optimism in this sector, was that the only winners through the year were companies focused on the monetisation of Artificial Intelligence (AI).

Whilst AI was certainly a strong contributor of returns to equity markets throughout 2023, there were plenty of other high-quality businesses achieving strong returns throughout the year. Other areas of advanced technology solutions continue to outperform, and our investment management partners continue to keep a close eye on interest rate sensitive sectors, such as real estate – where greater returns are expected in a rate cutting environment.

Looking ahead

2024 will be the year of elections. Billions of people will get to vote in over 70 countries, including the UK and US. Both regions have the potential to have a material impact on markets, however, it is expected that 2024 will be a generally positive year, with investors full of market optimism. We expect to see moderate returns across equity and fixed income markets.

The past year experienced some unusual activity in markets, which impacted the general optimism in global markets. 2023 was a year where a large contributor of positive returns in the market was due to a handful of companies. Returns in 2024 are not expected to be as concentrated.

We expect that quality and diversification will remain crucial to investors’ portfolios. We continue to keep close lines of communication with our investment management partners to ensure our clients continue to be invested in robust strategies, able to tackle upcoming market conditions.

Understanding market optimism with Francis Clark Financial Planning

Have any questions about market optimism or the future outlook of the investment landscape in 2024? Contact our dedicated team of financial planners today for expert financial advice and support.

Our team of experts offer financial planning advice for both businesses and individuals, specialising in a range of matters including wealth management, later life planning and retirement planning.

written by