Investment update: A strong start

The first quarter of 2024 saw positive returns across Global stock markets. Strong economic data, and a continued message early on in the year from Central Banks, on the expectations of rate cuts later in the year, resulted in a rise in equity markets.

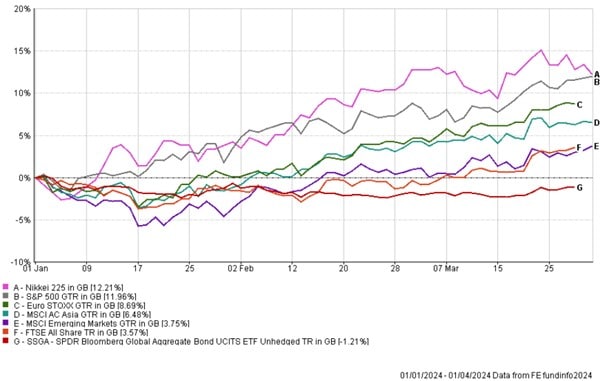

The chart below highlights all equity regions enjoying growth, with Japan and the US both experiencing double digit returns. The only index to show a negative return over the quarter is the Bond index proxy, showing a return of -1.21% for the quarter, due to the change in sentiment from Central Banks around rate cutting decisions.

Index Performance

Central banks start to change course

Throughout the first quarter of 2024, the sentiment around central banks in the west, such as the US Federal Reserve and the Bank of England, has slowly shifted due to strong economic data, moving away from expecting multiple rate cuts in the year, to there now being a possibility that rates are raised in order to combat sticky inflation as a result of strong economic data.

Optimism in Europe

As the chart above shows, Europe enjoyed a strong start to the year with positive market returns, and whilst lower, the UK based FTSE also posted positive figures for the quarter. Inflation in the region continues to fall, albeit slightly slower than originally expected.

Japan finally blossoms

Japan enjoyed a much awaited period of positive growth, both within markets and in the region’s economy, by finally raising rates for the first time in 17 years, coming out of a negative policy rate regime, as inflation and economic growth remain strong in the region. The local stock exchange, the Nikkei 225, reached an all time high moving past the previous high from 1989. Enthusiasm and positive sentiment within the region very much remains, and we see domestic participation increasing within the region which also contributes towards positive growth.

Looking ahead

The start of 2024 resulted in investors continuing to be confident inflation will move closer to target levels without the threat of a deep global recession. However, the risk remains, and is now possibly higher than before that we see a prolonged interest rate cutting cycle, and in some regions, possibly another hike before rates start to fall in order to combat the last, stickiest bit of inflation.

Our portfolios continue to be positioned with the long term view in mind. Our investment management partners are conducting constant analysis of the portfolios, ensuring the positions held are robust and in line with long term expectations.

Past performance is not a guide to future returns, if you would like further information on your portfolio please contact your local financial planner.

written by