What is Sustainable Investing?

Climate change concerns have driven a shift towards investing with positive intent in recent years, and this trend was intensified by Coronavirus. People are taking more care into where they place their money and what negative consequences their money may have in the world. This is where sustainable investing comes in. But what exactly is sustainable investing?

In context, there has been much debate about the opportunity to accelerate the transition to a low carbon economy as the world recovers from the economic consequences of the pandemic. Witness BP’s recent pledge to be Net Zero by 2050 as part of the global effort to reduce carbon emissions. Such a bold statement from a leading name in the petroleum business speaks volumes. Not only that, but this powerful claim may encourage sustainable investing.

What does sustainable investing mean for investors?

At Francis Clark Financial Planning, we work with some of the most respected names in the investment industry. Our investment management committee examines and questions their investment strategies to ensure these funds remain appropriate for our clients. It is our responsibility to build portfolios that represent good value for money, are robust and help to meet our shared sustainability goals.

It is part of our shared ambition to do our bit towards building a positive future through sustainable investment strategies for all of our clients. Any investment strategy must be commercial, long-term and cost-effective in order to be successful. We work closely with our chosen investment managers to get this balance right.

Part of our responsibility is to ensure portfolios reflect where we believe value for our clients can be achieved in the short, medium and long-term. In this regard we recognise that having sustainability as a key theme is vital.

What are sustainable investments and why do they matter?

The aftermath of the Covid pandemic has focused thoughts on developing our economy in a sustainable manner, and it is the companies at the forefront of these efforts that, with guidance from our investment partners, we seek to support through our sustainable investing portfolios.

An Environmental, Social and Governance (ESG) assessment is a recognised method of screening companies that might be appropriate to hold within a sustainable investment portfolio. Wherever appropriate, we prefer to hold funds that can demonstrate a positive environmental and social contribution. Naturally, sound governance within the underlying companies is a prerequisite.

By adopting sustainable investment strategies with a focus on ESG, stewardship and sustainability, at Francis Clark we are contributing to these positive aspirations whilst balancing risk and investment returns for our clients as part of our investment planning services.

Non-financial goals are an increasingly popular part of the financial planning considerations of investors across the world. These sustainability goals – such as wanting the underlying capital to support improving safe water treatment or advances in healthcare – are becoming ever more important to investors, and therefore play a growing role in the due diligence process our partners follow when deciding where to invest.

Fund in focus – Allianz Green Bond fund

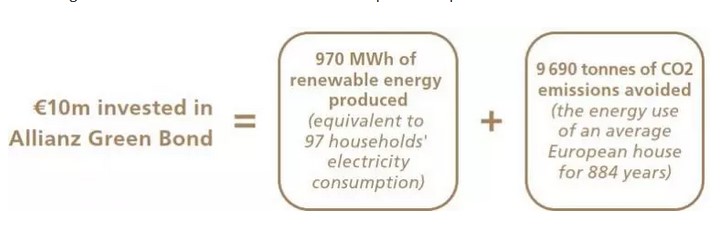

One way in which FC Financial Planning’s investment strategy is making a positive impact is through the Allianz Green Bond fund. This fund focuses on financing environmentally focused projects, so by investing in it our clients are able to contribute towards achieving more efficient and environmentally friendly energy around the globe. This is a great example of sustainable investing.

The image below illustrates the environmental impact of capital invested in the Allianz Green Bond fund.

At PKF Francis Clark, we are proud to have strong credentials in sustainable investing, whether through our highly reputable investment partners or our award-winning Corporate Finance team’s track record of assisting businesses to secure funding for green energy ventures.

People used to ask ‘what is sustainable investing?’ as the topic was relatively niche. Now there is growing recognition that future financial decision makers are asking more of companies as they seek to influence them to operate in a sustainable way. Our investment partners use their direct engagement with companies via shareholder voting activities to actively encourage them to deliver long-term sustainable growth and returns, but with a focus on ESG considerations.

They analyse, select and monitor the underlying holdings while we remain responsible for ensuring the end product is suitable for our clients. It is this ongoing scrutiny of the portfolio and assessment of suitability, combined with a personal financial plan, that FC Financial Planning clients trust us to deliver.

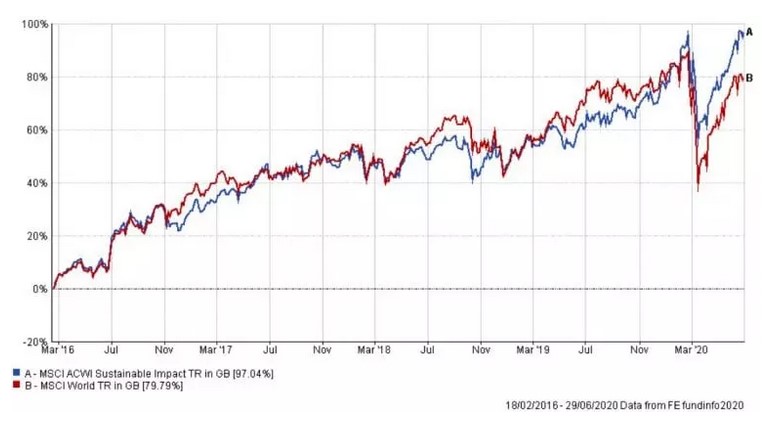

We believe it is important to have sustainable investing as a growing theme in a portfolio because evidence suggests that companies with strong stewardship and ESG credentials can generate better returns for our clients, as well as proving more resilient to market shocks.

The chart above shows the performance of the MSCI World Index compared to the MSCI Sustainable Impact Index since 2016. As the graph highlights, in the earlier periods the two indices tracked very closely to one another, however more recently the Sustainable Impact Index has recovered more strongly from the market volatility caused by the coronavirus pandemic. We believe this is testament to the financial and ethical case for sustainable investing.

Contact us for advice on sustainable investing and more

At Francis Clark Financial Planning, our team of qualified experts offer investment planning services which aim to get the most out of your money. Whether you prefer a low or high risk investment approach, our financial planners can create the right investment strategy for your needs. We offer a range of services for both businesses and individuals, including wealth management, retirement planning and business protection.

Still not completely sure about what sustainable investing is and its importance in the modern world? For further clarification and more information about our financial planning services, click here.

written by